3 min read

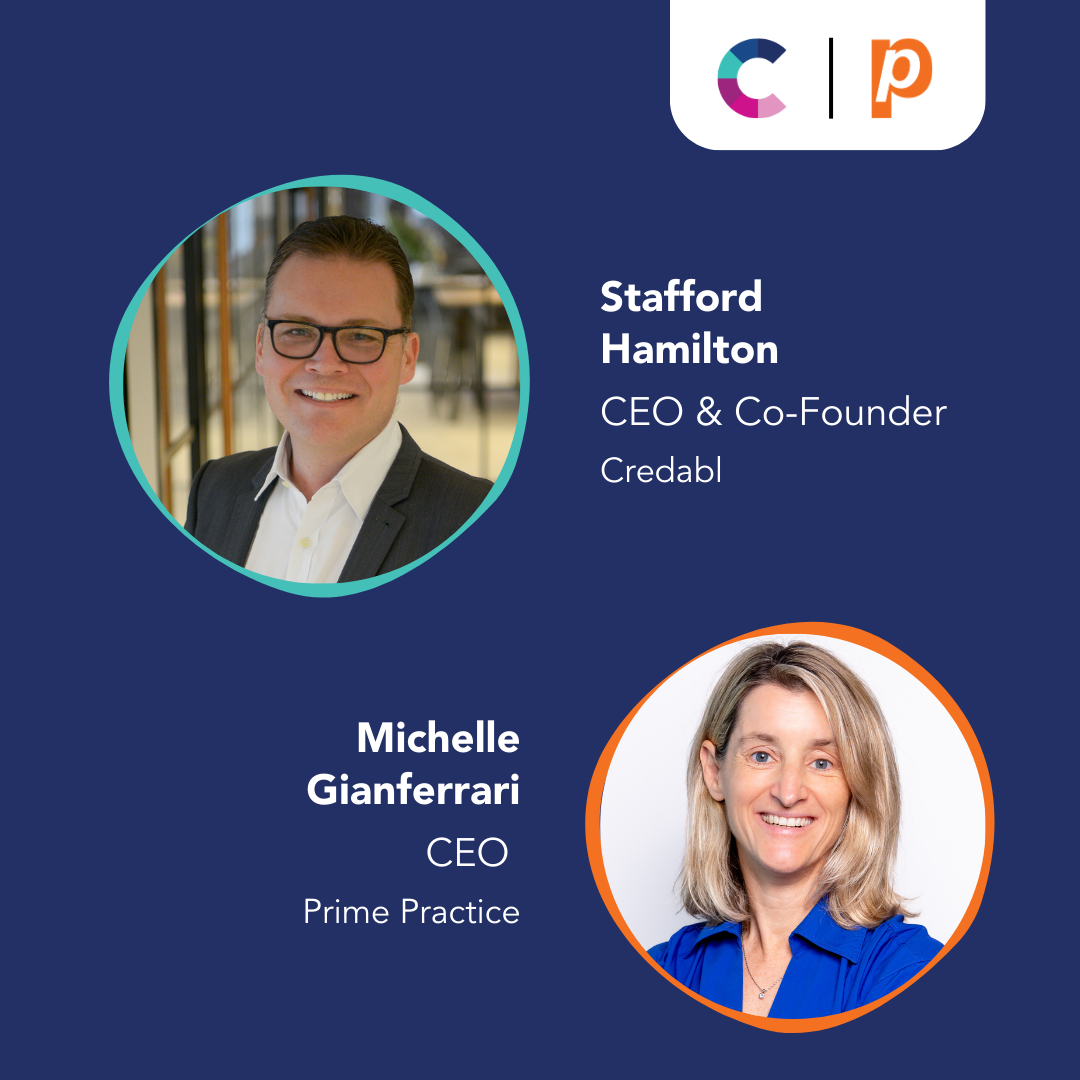

Credabl and Prime Practice have progressed to the next phase in their long-term plans for growth, with Credabl completing the acquisition of Prime Practice and appointing Michelle Gianferrari as its permanent Chief Executive Officer (CEO). …

3 min read

A new car purchase is so much more than deciding to buy a car and making the purchase; behind that, there are many steps in the process. To assist, we have put together some questions to ask yourself when buying a new car.…

5 min read

The prospect of shiny new equipment is always an exciting one, but you should take some time to ask (and answer) the right questions first. To get you started in this process, we have put together a list of considerations when buying new equipment.…

5 min read

Even those of us who conscientiously save for a rainy day can find ourselves under financial pressure, reinforce the importance of asking your lender for help. You could consider this as your first step and is one of the best things you can do during tough times.…

3 min read

Financial stress can permeate our overall emotional state and begin to show up in other areas, increasing the likelihood of experiencing anxiety and depression. It is for this reason that working to eliminate financial stress is important for mental wellbeing.…

3 min read

At a time when many of us are taking a well-deserved break, it can be good to reflect on how we spent our year and the healthy habits we want to adopt moving into the new year. …

5 min read

Home loans are something that we tend to set and forget – to determine whether your home loan is optimally set up for you, it can be useful to conduct a home loan health check…

5 min read

Home loan pre-approval is the very first step in purchasing a property and is simply a conditional approval, indicating specific loan terms and your borrowing capacity.…

5 min read

Credabl completed its inaugural capital markets term transaction for $250m on Thursday, 16 November 2023.…

5 min read

Continuing on that path, we will cover the process of purchasing an investment property, what to look for in an investment and the team you need to help you do it.…

5 min read

In order to demystify the process of property investment, we have put together some information to help you understand where to begin, what to consider, the different ways you can make it happen and how your end goal can determine what you decide to purchase.…